US President Joe Biden on Tuesday announced 100% tariffs on the importation of Chinese-made electric vehicles into the US. At the same time, Europe is conducting an anti-subsidy investigation into EV imports from China, with similar measures to the US being considered.

US President Joe Biden on Tuesday announced 100% tariffs on the importation of Chinese-made electric vehicles into the US. At the same time, Europe is conducting an anti-subsidy investigation into EV imports from China, with similar measures to the US being considered.

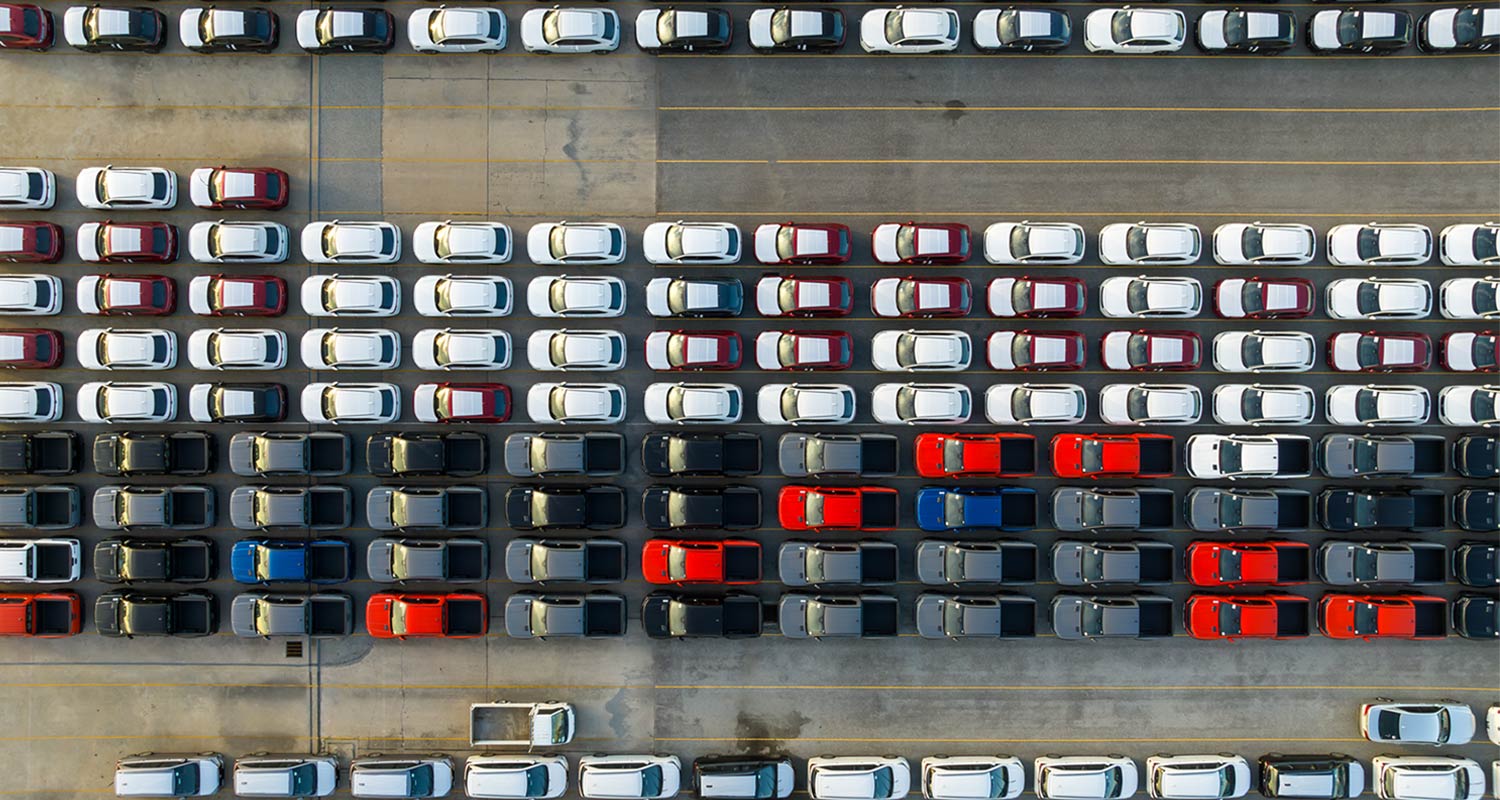

In both cases, regulators are concerned that cheap, subsidised Chinese EVs will flood domestic markets, undercutting local manufacturers and destroying homegrown motoring industries in the process, costing jobs and crimpling economic growth.

South Africa’s automotive sector is an important contributor to the economy, representing some 20% of the country’s total manufacturing output and contributing 5.3% to GDP in 2023.

Although South Africa’s EV plans are far behind Europe’s, many Western brands such as Ford, Volkswagen and BMW have made significant investments – many billions of rands – in manufacturing capacity for the production of internal combustion engine (ICE) vehicles that are exported to various markets around the world.

Do cheaper Chinese imports – whether ICE vehicles or EVs – threaten the sustainability of the local industry, too? And should government be making similar moves to the US and the EU to protect the industry? Or could the opposite be true: does the rise of Chinese car manufacturing represent an opportunity for South Africa?

“South Africa has a master plan that aims to achieve 1% of global production by 2035, but the world is shifting towards electric vehicles and South Africa’s policy is lagging behind,” said Hiten Parmar, executive director of the The Electric Mission, a non-profit that champions the decarbonisation of South Africa’s automotive and energy systems.

“We have seen what happened to Australia, they were in the same position as South Africa, attracting global brands to manufacture on their shores, but because they lacked proactive policy reforms from government, the automotive manufacturing industry in Australia evaporated.”

EV incentive scheme

According to Parmar, South Africa exports three in five vehicles made in the country to Europe. The EU, on the other hand, plans to ban the sale of new ICE vehicles in the region by 2035 to support its transition to EVs. Parmar identified outdated policy in a changing global vehicle market as the major threat to the local industry.

“If South Africa does not create that carrot, to say that we are fully committed to EV manufacturing and outline what the direct incentives for not only automotive manufacturing but also automotive component manufacturing are, we are going to struggle going forward,” he said.

In his budget speech in February, finance minister Enoch Godongwana announced an incentive scheme that will allow producers of electric and hybrid vehicles to claim up to 150% of “qualifying investment spending” in the first year as part of a package of measures aimed at supporting local manufacturers in the transition to electric mobility.

Read: The US is getting antsy about Chinese cars

Godongwana said government has set aside R964-million to supplement the incentive, but the scheme only comes into effect in two years’ time. Many industry stakeholders, including members of the Automotive Business Council, were disappointed by the minister’s announcement.

“We are already in 2024 and it’s still a long road ahead. These sorts of incentives should have been in place already so that we can start securing investment,” said Parmar.

Getting the right policy and incentives in place may make South Africa a more attractive investment destination for EV manufacturing, but that does not necessarily mean the country will be competitive against China, which actively subsidises EV production to support its industry, which has expanded rapidly in recent years.

But Parmar believes South Africa can attract investment from Chinese companies, which could make more sense than trying to compete with them.

Working in South Africa’s favour is the availability, at least regionally, of some of the minerals that are key to the production of EVs such as nickel, lithium and cobalt, meaning local manufacturers could, in theory, acquire these inputs more cheaply and quickly.

The introduction by the EU next month of the Carbon Border Adjustment Mechanism – a carbon tax that effectively penalises goods produced in regions where decarbonisation efforts are taken less seriously – will give countries that make an effort to produce goods in a decarbonised manner an advantage when exporting to that market.

“African countries are mining the minerals, putting them onto a ship and taking them to another country for processing, going to Europe for assembly and then we import it again. If we become proactive in South Africa, we can create a great manufacturing framework that will attract not only the Chinese but all OEMs (vehicle manufacturers) to set up plants here,” said Parmar.

South Africa is still attracting investment for the production of traditional ICE vehicles. This week, Peugeot parent company Stellantis announced that it is starting construction of a R3-billion bakkie assembly plant in the Eastern Cape. In a similar vein, VW announced a R4-billion investment to expand its Kariega plant, also in the Eastern Cape, in preparation for the production of new ICE-based SUV models. – © 2024 NewsCentral Media